Car title loans Richmond TX provide quick cash access for residents with bad credit or no history, secured by their vehicles. Regulated by state and federal bodies like TDB, FTC, and CFPB, these loans offer same-day approval, clear terms, and protected interest rates, making them a safe option for truck owners in need of short-term financial aid.

“Exploring Car Title Loans in Richmond, TX, requires understanding both the local regulatory landscape and the loan process. This article serves as a comprehensive guide for residents seeking short-term financing options. We delve into the intricacies of car title loans in Texas, highlighting the key roles played by regulatory bodies to protect consumers. By examining consumer protection measures and common loan terms, borrowers can make informed decisions. Stay tuned for insights on navigating Car Title Loans Richmond TX securely.”

- Understanding Car Title Loans in Texas

- Regulatory Bodies and Their Roles

- Consumer Protection and Loan Terms

Understanding Car Title Loans in Texas

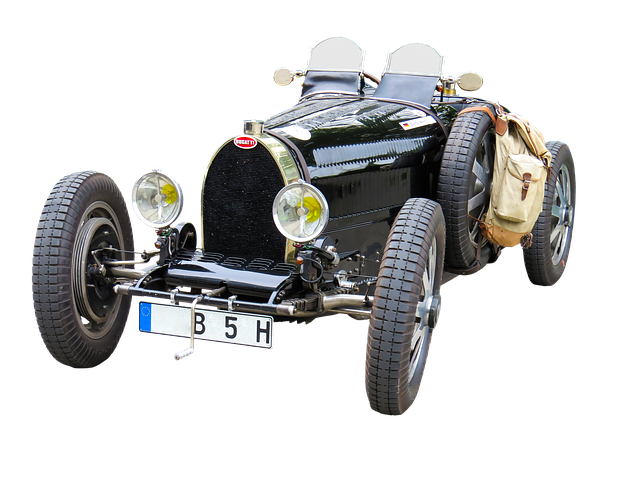

Car title loans Richmond TX have gained popularity as a quick financial solution for residents facing immediate cash needs. In Texas, these loans are secured by the borrower’s vehicle, typically a car or truck. The lender retains a lien on the title until the loan is repaid in full, providing a level of security for the lender. This type of loan is an attractive option for many due to its accessibility; even individuals with bad credit or no credit history can apply and potentially secure funding.

Loan eligibility criteria vary among lenders, but generally, Texas car title loans require proof of vehicle ownership, a valid driver’s license, and a stable source of income. Unlike traditional bank loans, these loans offer faster approval times, often within the same day. Additionally, there are options available for semi-truck owners seeking bad credit loans or emergency funding, providing a safety net during unforeseen circumstances.

Regulatory Bodies and Their Roles

In the landscape of Car Title Loans Richmond TX, several regulatory bodies play pivotal roles in ensuring consumer protection and fair lending practices. The Texas Department of Banking (TDB) serves as the primary regulator, overseeing all aspects of the state’s financial institutions, including car title loan providers. They enforce regulations that mandate transparent lending practices, clear terms, and fair interest rates, safeguarding borrowers from predatory lending schemes.

Additionally, the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) contribute to the regulatory framework by implementing federal laws that address debt consolidation, credit check procedures, and other financial solutions. These agencies play a crucial role in promoting responsible lending, ensuring that consumers have access to clear information about their loan terms, and providing avenues for dispute resolution when necessary.

Consumer Protection and Loan Terms

When exploring Car Title Loans Richmond TX, consumers must be aware of their rights and protections under state regulations. Texas has specific laws in place to safeguard borrowers from predatory lending practices. These measures ensure that individuals seeking a financial solution through a car title loan receive fair terms and conditions. The State’s regulatory framework includes clear guidelines on interest rates, loan fees, and repayment periods, providing borrowers with transparency and control over their financial obligations.

Understanding the title loan process is crucial for making informed decisions. Lenders in Texas must disclose all charges and terms clearly to borrowers, allowing them to assess their ability to repay. Loan eligibility criteria are also well-defined, ensuring that consumers can access this alternative lending method responsibly. By adhering to these regulatory standards, Car Title Loans Richmond TX providers offer a secure and beneficial loan eligibility option for those in need of quick financial assistance.

Car title loans Richmond TX have become a popular financial solution for many residents. However, it’s crucial to understand the regulatory landscape and consumer protections in place. The Texas Office of Credit Regulation oversees lenders, ensuring they adhere to fair lending practices. By understanding the loan terms and choosing a reputable lender, consumers can navigate this option securely. Stay informed about your rights and responsibilities to make an educated decision regarding car title loans in Richmond TX.